Key challenges to widespread adoption of clean hydrogen in urban mobility: a chicken-and-egg problem?

This is the third article of a trilogy about the application of hydrogen technologies in transport. The first one and the second one are still accessible on our website.

Our previous article briefly introduces the tech under the hood of fuel cell vehicles (FCV) and their main advantages over battery electric vehicles (BEV). Depending on the source of electricity, we saw that BEVs may not be as “green” as we perceive them. Therefore, as cities strive to reduce greenhouse gas emissions and improve air quality, clean hydrogen has emerged as a promising solution for decarbonizing urban mobility. However, despite its potential, several hurdles stand in the way of its widespread adoption.

Hydrogen fuel cell vehicles, in theory, combine the best of both worlds: the zero emissions, high efficiency, and quiet performance of electric vehicles, along with the fast refuelling and ease of use associated with gasoline-powered cars. So, what’s holding this technology back? In the following sections, we explore a few potential causes.

Limited hydrogen refuelling stations in urban areas

Building an extensive network of hydrogen refuelling stations demands substantial investment and careful coordination, which has been a key obstacle to the broad adoption of hydrogen vehicles. Without an adequate infrastructure, buyers are unlikely to choose cars that aren’t easy to refuel. Additionally, despite numerous commitments and funds poured into converting natural gas pipelines and facilities to hydrogen, these efforts have repeatedly fallen short in practice.

Additionally, a significant advantage of electric vehicles for many drivers is the ability to charge them at home, utilizing the existing electrical grid infrastructure, which is becoming cleaner and more efficient with each passing day. BEV technology is particularly well-matched for smaller vehicles. They don’t carry extremely heavy loads and are usually parked at home or at work for most of the day. This allows enough time to recharge the batteries, and it’s feasible to equip the vehicle with sufficient battery capacity to meet the customer’s needs.

Hydrogen’s adoption has been slow in part because it remains expensive (especially in the US) and there is not yet a robust fuelling network. According to the International Energy Agency (IEA)[1], the past year has seen a series of announcements that suggest a slowdown in the deployment of hydrogen refuelling stations (HRS), and the closure of many existing stations in a number of countries.

There are now close to 1.200 HRS in operation globally, but the overall total grew only marginally in 2024, as the number of new HRS being opened was partially offset by station closures around the world. For instance, Shell closed their California stations in February 2024, after having closed their UK stations in October 2022. In the same way, Everfuel reported low demand as being behind the closures, leaving a fleet of 100 Danish hydrogen taxis without access to hydrogen refuelling.

Fuel cell passenger car sales have struggled to gain momentum in Europe, resulting in much of the expensive infrastructure being underused. Meanwhile, in California, where sales have been relatively higher, frequent closures of refuelling stations have negatively affected consumer confidence.

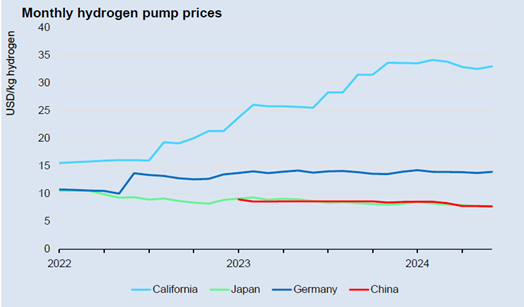

Nevertheless, the sharp rise in hydrogen prices is perhaps the most harmful factor: in California, the cost at hydrogen pumps more than doubled between 2021 and the end of 2023. While this problem was most acute in California, Europe’s H2 Mobility introduced dynamic pricing to prevent similar issues. This system adjusts prices based on the hydrogen’s source, as well as the station’s size and pressure level. As a result, by October 2023, the price for renewable hydrogen sales (around USD 10.3/kg for trucks and buses, and USD 11.9/kg for cars and vans) was 25-30% lower than the regular rate.

Figure 1: Monthly hydrogen pump prices [1]

Figure 1: Monthly hydrogen pump prices [1]

In essence, we may be facing a “chicken-and-egg problem”. Without fuel-cell vehicles on the road, there’s little incentive to invest in expanding HRS infrastructure. Conversely, it’s difficult to market and sell fuel-cell vehicles without a reliable HRS network.

Economic Viability

In recent years, the number of BEV sold has grown at an incredible pace, especially due to the intense production in China. According to the Global EV Outlook (2025) EV sales topped 17 million worldwide in 2024, rising by more than 25%, and representing more than 20% of new cars sold worldwide. This trend is expected to continue in 2025, with IEA forecasting another 25% global increase. Regarding the European market, about one in five new cars sold was electric in 2024.

In contrast, for example, at present, there are only two hydrogen-powered cars on the UK market: the Toyota Mirai, which has been sold for a decade, and the Hyundai Nexo, available since 2019. Both models can only be purchased through special order, with prices starting at approximately £60,000 and waiting periods of several months before delivery. As stated by the IEA, the total stock of FCV in the world in 2024 was around only 70 thousand vehicles, with almost no increase compared to 2023.

Hydrogen may not be as green as we think

Hydrogen production reached 97 million tonnes in 2023, with low-emission hydrogen making up less than 1% of the total. The sector remains heavily reliant on fossil fuels without carbon capture, a pattern that has persisted in recent years and is expected to continue through 2024. The dominant method involves using unabated natural gas, which accounts for roughly two-thirds of global hydrogen output. This traditional form, known as “grey hydrogen,” is produced without capturing carbon emissions, contributing significantly to greenhouse gas levels. Unfortunately, according to the IEA, generating renewable hydrogen today typically costs between 1.5 to 6 times more than producing it from unabated fossil sources.

However, not everything is lost. Buses keep hope in the sector!

The number of fuel cell buses grew by nearly 25% in 2023 compared to the previous year. China led this expansion, adding over 75% of the more than 1,500 new fuel cell buses introduced that year, maintaining a comparable share of the global fleet, which exceeded 9,100 buses as of June 2024. Year-on-year growth rates in Europe and Japan were similar to China’s, ranging between 20% and 25%, while South Korea saw an impressive annual increase of 130%.

Fuel cell buses are still being tested, frequently alongside battery electric alternatives. Numerous European cities have either received or ordered fuel cell buses, including Barcelona (Spain), Bologna (Italy), Cottbus and Oberberg (Germany), Paris (France), and Wałbrzych (Poland). Several German cities with existing fuel cell bus operations, such as Frankfurt and Cologne, have chosen to increase the size of their fleets.

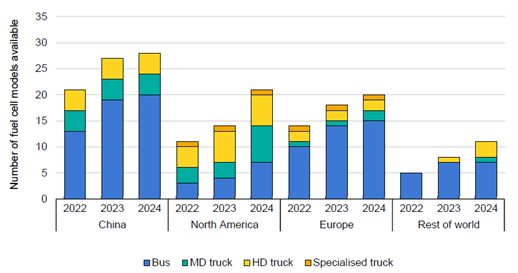

Key to the increasing sales of fuel cell buses is sufficient availability. In Europe, companies such as Solaris and Wrightbus are expanding production.

Figure 2: Fuel cell electric vehicle models by original equipment manufacturer headquarters, type of vehicle, and release date [1]

In 2023, Solaris was awarded a contract to deliver 137 hydrogen-powered Urbino 12 buses to TPER (Trasporto Passeggeri Emilia-Romagna), the public transport authority in Bologna[2]. This marks one of the largest fuel cell bus procurements in Europe and supports Bologna’s objective of achieving a completely zero-emission urban transit system by 2030. This investment in fuel cell buses is being jointly funded through EU resources provided by the PNRR plan, along with contributions from TPER itself.

Currently, most fuel cell buses operate in urban and suburban areas, where, despite their higher purchase and operating costs, they offer notable benefits. A clear example is Vienna’s decision to adopt hydrogen buses for city centre routes. In 2024, the bus operator placed an order to replace 12 battery electric buses for 10 fuel cell buses in two routes of the system. According to the company, the decision was based on the fact that with fuel cell buses, charging infrastructure is no longer needed in the city centre, and they could cut 2 buses from the operation.

Conclusion

While clean hydrogen holds significant promise for transforming urban mobility, its large-scale adoption faces complex technical, economic, and policy barriers. Overcoming these will require sustained investment, public-private collaboration, and a clear strategic vision. If addressed effectively, hydrogen could become a cornerstone of clean and resilient urban transportation systems.

References:

[1] IEA – Global Hydrogen Review 2024

[2] https://www.solarisbus.com/en/press/solaris-delivers-first-hydrogen-buses-to-bologna-2275

Latest news

All news

Collaborative mobility planning takes a major step forward in Alto Minho

This week, Ponte de Lima hosted an important milestone for sustainable mobility in the Alto Minho region, with the working sessions of the 2nd-generation Sustainable Urban Mobility Plan of Alto Minho (SUMP Alto Minho), promoted by CIM Alto Minho. At VTM, we are proud to support CIM Alto Minho in the development of a new-generation […]

VTM welcomes Oriol Riba and Alessandra Bernardi

VTM is pleased to announce the addition of two highly experienced professionals, Oriol Riba and Alessandra Bernardi, further strengthening our capabilities across infrastructure advisory and transport modelling. Oriol Riba joins VTM as a Senior Associate Director with more than fourteen years of experience in the infrastructure sector, with a strong focus on transport and additional exposure to energy […]