A brief introduction to hydrogen fuel cell vehicles

This is the second article of a trilogy about the application of hydrogen technologies in transport. The first one can be found here.

During the previous decade, we have witnessed a pivotal shift in the automotive industry, steering away from traditional internal combustion engines (ICE) towards more sustainable alternatives. Among these, fuel cell vehicles (FCVs) have emerged as a promising pathway to a greener future. Powered by hydrogen, the most abundant element in the universe, FCVs represent a key innovation in our pursuit of sustainable transportation solutions. Unlike conventional vehicles, which rely on fossil fuels, FCVs use hydrogen to generate electricity in the form of direct current (DC) through a chemical process within a device called fuel cell stack, propelling the vehicle without any tailpipe emissions besides water vapour.

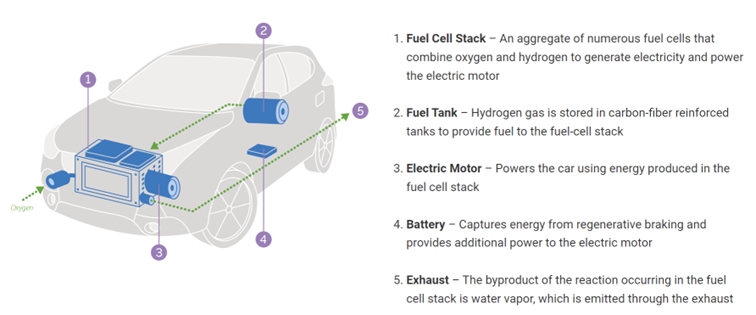

This chemical process has several interlinked reactions, which take place continuously, providing a consistent source of electricity for as long as hydrogen and oxygen remain available [1]. The FCVs are designed to incorporate the fuel cell system, hydrogen storage, and electric drivetrain components. Figure 1 presents the key elements of the design and structure of a fuel cell car.

Figure 1: Main components of a fuel cell car. Source: driveclean.ca.org

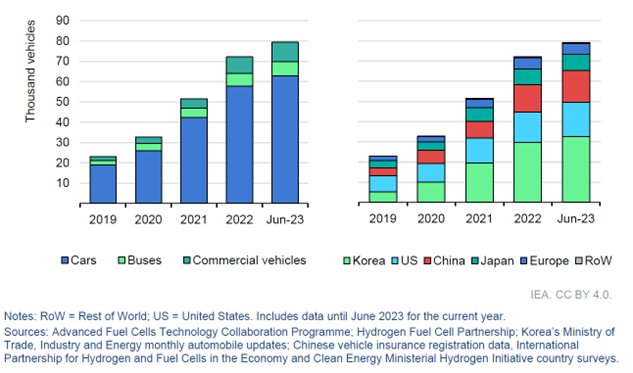

By the end of 2022, the stock of fuel cell cars and vans exceeded 58.000 units, an almost 40% increase compared to the previous year, and has reached around 63.000 in the first half of 2023 [2], with Korea remaining the major market for cars and China for trucks. Reflecting Korea’s dominance in domestic fuel cell car sales, Hyundai’s Nexo represented the best-selling fuel cell car (10.000) in 2022; Toyota’s Mirai came in second (3.200). In comparison, the total global fleet of battery electric vehicles (BEVs) reached an estimated 18 million units by 2022 [3].

Fuel cell buses

The inventory of fuel cell buses expanded at a comparable rate to that of light-duty vehicles, witnessing approximately a 40% increase in 2022 relative to the year before. By June 2023, the global number of fuel cell buses reached roughly 7.000, with China housing about 85% of this total after incorporating around 1.300 new fuel cell buses in 2022.

Europe holds the position for the second-highest number of these buses, with Korea and the United States trailing behind. A total of 370 fuel cell buses were in operation in Europe in January 2023. But there are plans to get over 1,200 by 2025[4].

Figure 2: Fuel cell electric vehicle evolution by segment and region, 2019-2023. Source: IEA – Global Hydrogen Review (2023)

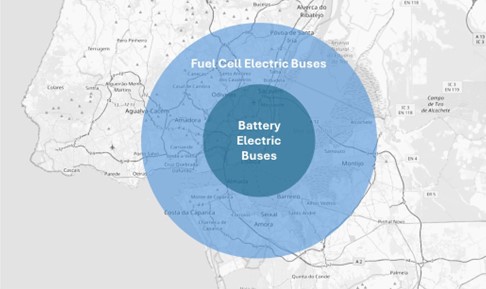

Hydrogen as a fuel in urban bus transport presents several benefits over available alternatives. Hydrogen fuel cell buses (FCB) boast an average range of 500-600 km, enhancing vehicle efficiency and minimizing the need for frequent refuelling. In contrast, the typical range for a battery electric bus (BEB) is around 300 km, though this figure can vary based on the model and manufacturer[5].

Besides the considerably higher range than BEB, the key advantage of hydrogen buses is the short refuelling time, which is, on average, 10 minutes. This replicates the convenience of traditional diesel buses but without the environmental impact. Charging time for battery buses is much longer. Depending on the method, it may take 3-5 hours when using a DC fast charger or approximately 1 hour when using a pantograph[6]. This can translate into lower operational costs (OPEX) and higher efficiency, particularly for transit agencies with demanding schedules and routes.

In intensive operations, especially those in urban and metropolitan areas, where buses run several services per day, this reduction in refuelling time (consequently on downtime) can also be translated as less CAPEX. In terms of bus scheduling, with much shorter refuelling times, cycle times are reduced, allowing the same bus to provide more services per day, which translates into fewer buses to do all the contracted services. Therefore, BEBs may be seen as more suitable for urban operations (shorter lines), whereas FCBs are ideal for suburban lines and intense BRT operations with articulated buses (longer lines with shorter downtime).

Figure 3: The trend for FCBs and BEBs operations. Source: VTM

Another point in favour of FCBs is that they generally perform better in cold weather conditions compared to BEBs. Batteries can lose efficiency and capacity in cold temperatures, which can significantly reduce the range of BEBs. Hydrogen fuel cells, on the other hand, are less affected by cold weather, maintaining a more consistent performance and range. In addition, the weight and space required for batteries in BEBs can be substantial. Hydrogen fuel cells, being lighter and more compact for the same energy output, allow for more passenger space and less impact on vehicle design and road wear.

In terms of emissions, while both FCBs and BEBs produce zero tailpipe emissions, the source of electricity for BEBs can also affect their overall environmental impact. If the electricity used to power the BEBs’ batteries comes from a grid that relies heavily on fossil fuels, the operation may be not considered net zero. For instance, according to Eurostat[7], the weight of fossil fuels on electricity production in Norway is only 1,0 %, while in Poland, it is 78,1%. For the sake of comparison, considering the same BEB model and the same network, this operation would be much more “cleaner” in Norway than in Poland. Therefore, FCBs powered exclusively by green hydrogen can have a lower total environmental impact compared to BEBs charged from a grid supported heavily by electricity production based on fossil fuels.

Finally, the key to introducing hydrogen buses and increasing their number in our cities is to ensure stable supplies of hydrogen fuel at competitive prices. As presented in our last article, the source of hydrogen itself is also essential. The EU’s goal is to use green hydrogen, i.e. produced in the electrolysis process using energy from renewable sources, which guarantees decarbonization at all stages of bus operations.

In the following article, the last one of this trilogy about hydrogen, we will present the pressing challenges to reach a wide adoption of clean hydrogen in urban mobility in the near future.

References:

[1] For detailed information about fuel cell stack chemical reactions and operation see Hassan, Q.; Azzawi, I.D.J.; Sameen, A.Z.; Salman, H.M. Hydrogen Fuel Cell Vehicles: Opportunities and Challenges. Sustainability 2023, 15.

[2] IEA – Global Hydrogen Review (2023)

[3] Economist Intelligence Unit

[4] Sustainable bus (2024)

[5] SES Hydrogen (2023)

[6] SES Hydrogen (2023) – Depending on the model, charging time may be longer than 10 hours with an AC standard charger (22 kW).

[7] Source: Production of electricity and derived heat by type of fuel. Dataset: nrg_bal_peh__custom_9767105. Eurostat ( 2022)

Latest news

All news

New study reveals how street network layout shapes urban mobility cultures across Europe

A collaboration including VTM’s Cristian Adorean uncovers fresh insights into the relationship between city design and travel behaviour. A new study published in Cities examines how the layout of street networks—measured as “circuity”—relates to varied mobility cultures across 41 European cities. Co-authored by VTM senior consultant Cristian Adorean, the research explores how urban environments shape […]

Key challenges to widespread adoption of clean hydrogen in urban mobility: a chicken-and-egg problem?

This is the third article of a trilogy about the application of hydrogen technologies in transport. The first one and the second one are still accessible on our website. Our previous article briefly introduces the tech under the hood of fuel cell vehicles (FCV) and their main advantages over battery electric vehicles (BEV). Depending […]