Demand & revenue study for the EU Atlantic rail freight corridor

VTM was part of a consortium composed also by SETEC (Fr), EPYPSA (Es), and PROGNOS (G), which jointly delivered the initial (2012) and the updated (2015) transport market studies for the corridor.

Demand forecasts on freight flows on the Corridor were provided taking into account economic forecasts, context, demand, supply, and determinants of modal choice. Based on these results, it was possible to produce a first estimate of the capacity allocation (pre-arranged train paths) that would be necessary to put in place to ensure that rail meets the expected evolution of international freight traffic demand on the corridor for the project years of 2030 and 2050.

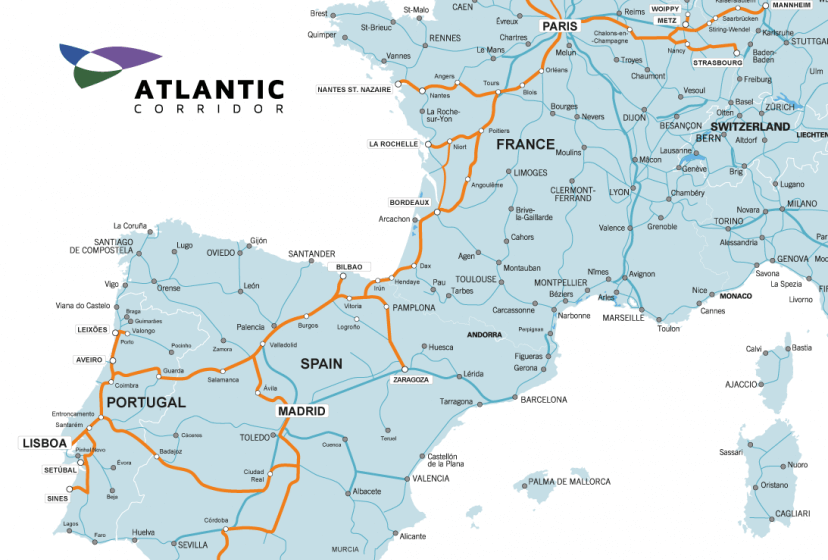

The Atlantic Corridor railway, included in the Core Network Corridor (ATL CNC), is over 8,200 km long and crosses four countries: Spain, Portugal, France and Germany. providing for the continuity of the networks between Lisbon, Madrid, Paris and Strasbourg/Mannheim. The mission of the Atlantic Corridor covers the management of existing infrastructures, without additional investments, through centralized management of capacity allocation, traffic management and costumer relationship.

Subsequently, the Atlantic Corridor also works as a coordination platform between Portugal, Spain, France and Germany concerning the investments in infrastructure, overcoming technical and operational barriers, promoting interoperability and, ultimately, increasing the competitiveness of rail freight. It includes the following sections:

- Algeciras – Bobadilla – Madrid

- Sines / Lisboa – Madrid – Valladolid

- Lisboa – Aveiro – Leixões/Porto

- Aveiro – Valladolid – Vitoria – Bergara – Bilbao/Bordeaux – Paris – Le Havre/Metz – Mannheim/Strasbourg

VTM lead the development of the Economic and Territorial framework analysis for Portugal as well as a competitive assessment of domestic and international freight transport, and conducted the discrete choice exercise dealing with the determinants (attributes and factors) influencing the choice of transport mode (price, time, reliability …).

An extensive set of stated preference surveys was conducted with the actors of freight transport (shippers or freight forwarders) througout the corridor, supported on comprehensive discussions undertaken with a large variety of stakeholders in the four countries covered by the RFC4, i.e. port operators, railway operators, terminal operators, shipping companies, corridor managers, infrastructure managers and logistic operators.

Related case studies

All case studies

Demand study for a Spanish-based High Speed Rail operator

An operator active in the Spanish HSR market following its liberalisation was awarded by ADIF with a reserved capacity of daily round trips on the main Spanish high-speed routes for 10 years. With the liberalization, three further actors started operations on the Spanish HSR network, with tangible results: when comparing the first quarter of 2019 […]

Improving international railway corridors in Iberia and with the rest of Europe

Today, international rail freight transport plays a secondary role vis-à-vis road and maritime modes, with relatively low market shares both in Portugal and Spain. In this sense, one of the objectives of the European Economic Interest Grouping – High Speed Spain-Portugal (AEIE-AVEP) is to increase the quality of supply with a view to increase international […]