Demand study for a Spanish-based High Speed Rail operator

An operator active in the Spanish HSR market following its liberalisation was awarded by ADIF with a reserved capacity of daily round trips on the main Spanish high-speed routes for 10 years.

With the liberalization, three further actors started operations on the Spanish HSR network, with tangible results: when comparing the first quarter of 2019 to the first quarter of 2023, travellers on HSR increased by 56% and 76% – respectively on the Madrid-Barcelona and Madrid-Valencia routes.

The objectives reached by our client with this project were:

- To design, develop, and share with the client a tool able to model its market share on specific HSR routes, considering the monthly evolution of demand but also taking into consideration the evolution in the number of HSR competitors and/or the number of services supplied by each, or relevant cross-elasticities to other modes supply attributes such as plane fares or private vehicle costs (eg. toll costs).

- To provide the necessary quantitative support on demand projections to help select between two alternative assignments of the client’s fleet for 2024 to support train path negotiations with ADIF.

Essentially, delivering this advisory entailed:

- Developing a strategic market analysis of the historical evolution of demand and the modal split on each of the above corridors.

- Raising a sound understanding of what drives travelers’ mode choices through the calibration of route specific discrete choice models, supported by revealed preference data.

- Supported on the above, estimate each route’s market evolution (supply & demand) until 2024, and project the client’s market share.

This successful advisory helped pave the way to consolidate our relationship with the client’s marketing team and fostered a pipeline of additional advisories.

Related case studies

All case studies

Improving international railway corridors in Iberia and with the rest of Europe

Today, international rail freight transport plays a secondary role vis-à-vis road and maritime modes, with relatively low market shares both in Portugal and Spain. In this sense, one of the objectives of the European Economic Interest Grouping – High Speed Spain-Portugal (AEIE-AVEP) is to increase the quality of supply with a view to increase international […]

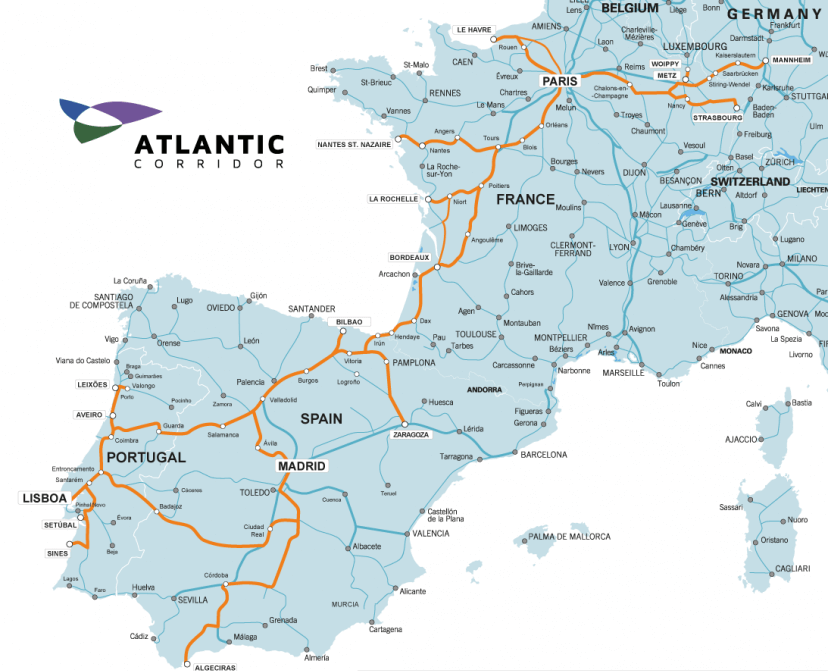

Demand & revenue study for the EU Atlantic rail freight corridor

VTM was part of a consortium composed also by SETEC (Fr), EPYPSA (Es), and PROGNOS (G), which jointly delivered the initial (2012) and the updated (2015) transport market studies for the corridor. Demand forecasts on freight flows on the Corridor were provided taking into account economic forecasts, context, demand, supply, and determinants of modal choice. […]